Get the Latest Insights on Price Movement and Trend Analysis of Gasoline in Different Regions Across the World (Asia, Europe, North America, Latin America, and the Middle East & Africa)

In an ever-evolving global market, understanding the intricacies of gasoline prices and trends is essential for stakeholders across various industries. This comprehensive analysis delves into the definition of gasoline, key details about its price trends, industrial uses impacting these trends, the latest news and updates, and key players shaping the market. Stay informed with the latest insights on gasoline prices and trends across Asia, Europe, North America, Latin America, and the Middle East & Africa.

Definition of Gasoline

Gasoline, also known as petrol in some regions, is a volatile, flammable liquid hydrocarbon mixture used primarily as fuel in internal combustion engines. Derived from crude oil through a refining process, gasoline is essential for powering vehicles, machinery, and various industrial applications. Its composition varies slightly depending on the crude oil source and refining methods, but it typically consists of hydrocarbons with carbon numbers ranging from C4 to C12. The quality of gasoline is determined by factors such as octane rating, vapor pressure, and the presence of additives designed to improve performance and reduce emissions.

Request For Sample: https://www.procurementresource.com/resource-center/gasoline-price-trends/pricerequest

Key Details About the Gasoline Price Trend

The gasoline market is influenced by a myriad of factors, including crude oil prices, geopolitical events, supply chain disruptions, and seasonal demand fluctuations. Analyzing gasoline price trends provides critical insights for businesses and consumers alike, helping them navigate the complexities of fuel costs.

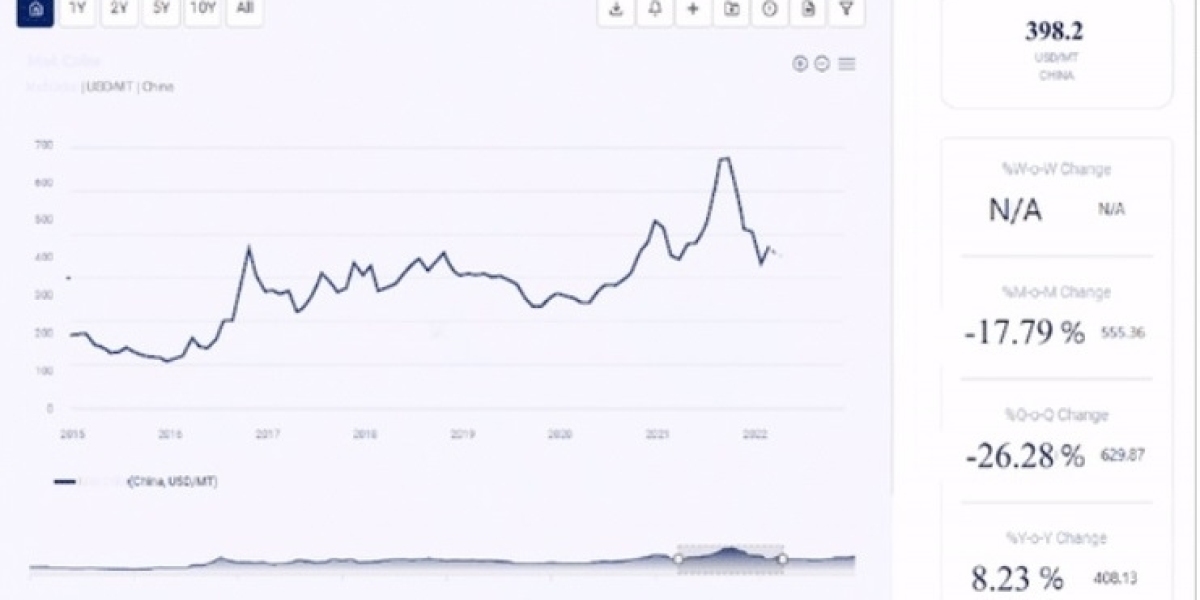

Asia: In Asia, gasoline prices are heavily influenced by the region's dependence on imported crude oil. Major economies like China, India, and Japan play significant roles in the demand dynamics. Recent trends show a fluctuation in prices due to varying crude oil supply and changing consumption patterns. Economic growth and industrial activity in these countries are pivotal in determining gasoline prices.

Europe: European gasoline prices are among the highest globally due to high taxation and stringent environmental regulations. The transition towards renewable energy sources and electric vehicles is also affecting gasoline demand. Recent geopolitical tensions, particularly the Russia-Ukraine conflict, have added volatility to the market, leading to price spikes and supply concerns.

North America: In North America, particularly the United States, gasoline prices are influenced by domestic production levels, refinery capacities, and hurricane seasons that can disrupt supply chains. The shift towards shale oil extraction has provided some stability, but prices remain susceptible to global market dynamics and local legislative changes.

Latin America: Latin American countries, with varying levels of self-sufficiency in oil production, exhibit diverse gasoline price trends. Venezuela, with its vast oil reserves, has some of the lowest gasoline prices, whereas countries reliant on imports face higher costs. Political instability and economic policies significantly impact price movements in the region.

Middle East & Africa: The Middle East, being a major oil-producing region, typically enjoys lower gasoline prices. However, domestic policies, subsidies, and global oil market trends influence the prices. Africa presents a mixed scenario, with oil-producing nations benefiting from lower prices, while import-dependent countries face higher costs due to infrastructure challenges and geopolitical risks.

Industrial Uses Impacting the Gasoline Price Trend

Gasoline's primary use is as fuel for internal combustion engines, which powers a vast array of vehicles, including cars, motorcycles, boats, and light aircraft. Additionally, gasoline is used in small engines, such as those in lawnmowers, generators, and agricultural machinery. The industrial uses of gasoline significantly impact its price trends:

Transportation Sector: The largest consumer of gasoline, the transportation sector's demand is closely tied to economic activity and consumer behavior. Fluctuations in vehicle sales, travel patterns, and logistical operations directly influence gasoline consumption and prices.

Agricultural Sector: Gasoline powers various agricultural equipment, impacting farming costs. Seasonal agricultural activities, particularly planting and harvesting periods, drive demand fluctuations in rural areas.

Construction Sector: Construction equipment, such as concrete mixers and generators, relies on gasoline, especially in remote areas without access to electrical power. The pace of construction projects can lead to localized spikes in gasoline demand.

Recreational Use: Gasoline is used in recreational vehicles and equipment, including boats, jet skis, and off-road vehicles. Seasonal recreational activities, particularly during summer months, can lead to increased gasoline consumption and higher prices.

Latest News and Updates

Staying updated with the latest news in the gasoline market is crucial for anticipating price movements and making informed decisions. Recent developments include:

Geopolitical Events: The ongoing conflict between Russia and Ukraine has disrupted global oil supplies, leading to heightened volatility in gasoline prices. Sanctions on Russian oil exports have further tightened supply, affecting prices in Europe and beyond.

OPEC+ Decisions: The Organization of the Petroleum Exporting Countries (OPEC) and its allies, collectively known as OPEC+, continue to play a pivotal role in determining oil production levels. Recent decisions to either cut or increase production have direct implications for gasoline prices globally.

Technological Advancements: Innovations in refining technologies and the development of more efficient engines contribute to changes in gasoline demand and prices. Advances in biofuels and alternative energy sources also impact the gasoline market.

Environmental Regulations: Stricter emissions standards and the push towards renewable energy sources are reshaping the gasoline market. Governments worldwide are implementing policies to reduce carbon footprints, influencing gasoline demand and prices.

Key Players

The gasoline market is dominated by major oil companies and refining giants that influence production, pricing, and distribution. Key players include:

ExxonMobil: As one of the world's largest publicly traded oil companies, ExxonMobil plays a significant role in the gasoline market. Its extensive refining and distribution network ensures a steady supply of gasoline across various regions.

Royal Dutch Shell: Shell is a global leader in the oil and gas industry, with a robust presence in refining and retail. The company's investments in renewable energy also impact its gasoline market strategies.

BP: British Petroleum (BP) is a key player in the global gasoline market, with a focus on efficient refining processes and sustainable energy solutions. BP's global footprint ensures its influence on gasoline prices and trends.

Chevron: Chevron's extensive operations in upstream and downstream activities make it a critical player in the gasoline market. The company's investments in advanced refining technologies and alternative fuels shape its market position.

Saudi Aramco: As the world's largest oil producer, Saudi Aramco significantly impacts global gasoline prices. The company's vast reserves and refining capacity ensure a stable supply, influencing market dynamics.

Conclusion

In conclusion, understanding the gasoline market's complexities requires a comprehensive analysis of price movements, trends, and the factors driving them. The influence of geopolitical events, industrial uses, technological advancements, and key players shapes the gasoline market across different regions. Staying informed with the latest insights and updates is crucial for businesses and consumers navigating the dynamic landscape of gasoline prices.

Procurement Resource provides invaluable data and analysis for stakeholders in the gasoline market. With a focus on detailed price trends, market dynamics, and key developments, Procurement Resource offers essential tools and insights to help businesses make informed procurement decisions. Whether it's tracking the impact of geopolitical events, understanding industrial demand fluctuations, or identifying the strategies of key market players, Procurement Resource equips stakeholders with the knowledge needed to navigate the gasoline market effectively.